Harveys Insolvency | Latest Insolvency News

Insolvency & Turnaround News

Harveys hope that you find our news page of interest,

we look to cover noteworthy issues in or around our sector.

We also list businesses or forthcoming sales of assets by private treaty or auction under 'For Sale'.

Harveys Insolvency News

Creditors and Customers of Hope Fashion A trading style of NM Hope Limited Frequently Asked Questions Index of FAQ’s 1. Refund Due for returned items 2. Order not received 3. Gift Vouchers 4. Prospects of creditors being paid in the Liquidation 5. I am owed money, but have not received a notice of the Liquidation 6. Who gets paid first in this Liquidation? 7. Will Hope Fashion open again? 8. How can I get in touch with former Directors and staff of Hope Fashion 9. Hope Fashion Website 10. Liquidation process explained. 1. Refund Due for returned items Hope Fashion made its best endeavours to ensure that all identified consumer refund were processed prior to creasing to trade. In the event that you have not received a refund, you will be an unsecured creditor in the Liquidation proceedings. Please see the FAQ ‘I am owed money, but have not received a notice of the liquidation’ for what to do. In addition, if you have paid for goods by credit or debit card and they are not received, you may be able to get your money back by claiming a refund from your card issuer. Please contact your card issuer as soon as you can if this applies to you. Further information including time limits, is available from Money Helper website at: https://www.moneyhelper.org.uk/en/everyday-money/credit-and-purchases/how-youre-protected-when-you-pay-by-card 2. Order not received The website closed for orders at 1pm om 9 June 2023. All orders, for which payment was received, have been dispatched by Hope Fashion prior to ceasing to trade. If Hope Fashion was unable to complete delivery of your order, it will have refunded your payment prior to ceasing to trade. Please allow a few days for the payment to have been transacted. In the event that you have not received a refund or your order, you will be an unsecured creditor in the Liquidation proceedings. Please see the FAQ ‘I am owed money, but have not received a notice of the liquidation’ for what to do. If you have paid for goods by credit or debit card and they are not received, you may be able to get your money back by claiming a refund from your card issuer. Please contact your card issuer as soon as you can if this applies to you. Further information, including time limits, is available from Money Helper website at: https://www.moneyhelper.org.uk/en/everyday-money/credit-and-purchases/how-youre-protected-when-you-pay-by-card 3. Gift Vouchers Hope Fashion can no longer honour its gift vouchers or any credits held. Any sum due to you for the gift voucher or credit you will rank as an unsecured creditor in the Liquidation proceedings. Please see the FAQ ‘I am owed money, but have not received a notice of the liquidation’ for what to do. In addition, if the voucher was paid for by credit or debit card the purchaser may be able to get the money back by claiming a refund from the card issuer. Please arrange for the card holder to contact their card issuer as soon as you can if this applies. Further information, including time limits, is available from Money Helper website at: https://www.moneyhelper.org.uk/en/everyday-money/credit-and-purchases/how-youre-protected-when-you-pay-by-card 4. Prospects of creditors being paid in the Liquidation Based on current information it is not anticipated that any monies will become available to the unsecured creditors. Please see ‘Who gets paid first in this Liquidation’. If this position changes, creditors will be advised in future communications from the liquidator. 5. I am owed money, but have not received a notice of the Liquidation If you are a creditor (owed money by the Company) and have not received notice of the intention to place the Company into Creditors Voluntary Liquidation on 28 June 2023 or the commencement of the Liquidation thereon please email Josie@HarveyInsolvency.co.uk with your details. The following information is required in your email: Name Address Email Telephone Number Amount due to you Evidence of the sum due (ie if a returned item, the postage receipt and details of your order returned) How do you want us to respond to you, by email/by letter. We will respond to you by email, unless stated otherwise by you. We will provide you with a copy of the last notice sent to creditors and access to the creditors online portal. This portal provides copies of all documentation made available to creditors throughout the liquidation proceedings for no less than three months from being issued. 6. Who gets paid first in this Liquidation? The priority of payments in insolvency is stated by legislation under the Insolvency Act 1986. In this matter the order is as follows: - 1. Costs Expenses and costs of the liquidation proceedings. 2. Preferential Creditors Employee (PAYE) wages to £800 and accrued holiday pay. 3. Secondary Preferential Creditors HMRC for VAT, PAYE & employee NIC deductions. 4. Unsecured Creditors All other parties ‘owed’ money by the Company. 7. Will Hope Fashion open again Efforts to sell the Hope Fashion as a going concern have been unsuccessful to date. It is highly unlikely that Hope Fashion will trade as it has done in the past. 8. How can I get in touch with former people at Hope Fashion Individual data of staff, Directors and customers of Hope Fashion is protected by GDPR and the liquidator or any other party associated with Hope Fashion are unable to answer these questions. However, the liquidator will pass on details of parties to the former management where sought. It is at the discretion of the recipient whether contact is made. Please email Josie@HarveyInsolvency.co.uk with your request. 9. Hope Fashion Website From 9 June 2023 no further sales will be made from the website. The website is part of the intangible assets of the Company and are for sale. The website will eventually close or come under the control of a new owner. 10. Liquidation process explained On 9 June 2023 notices have been sent to the owners (shareholders) and creditors (people who are known to be owed money) that the Company will be liquidated on 28 June 2023. On 28 June 2023, the Company will be placed into Creditors Voluntary Liquidation by the shareholders. Creditors are anticipated to have given their deemed consent to the appointment of the members liquidator. In the intervening period to Directors will conduct their duties and prepare for the winding of the Company. Harveys Insolvency & Turnaround of 2 Old Bath Road, Newbury, Berkshire, RG14 1QL have been engaged to assist the Directors with this process and their Insolvency Practitioner Debi Harvey is anticipated to be appointed Liquidator. Initial contact, where required should be made by email to Josie Badman at Josie@HarveyInsolvency.co.uk . Debi Harvey is an insolvency practitioner licensed by the Institute of Chartered Accountants England & Wales under licence number 12150 and she and her firm are bound by the Insolvency Code of Ethics. D J Harvey Harveys Insolvency & Turnaround Limited 9 June 2023

Today marks ’10 Years in Business’ for Harveys Insolvency & Turnaround and our whole team are delighted to be celebrating such a great milestone! This could not have been achieved without the many amazing people who refer clients to us; and the accountants, solicitors, and agents who we have had the pleasure of working alongside. Thank you all! I extend a special thank you to our team of staff who are so vested and committed to our business and to the past staff whole have been part of our journey. Without you all we would not be who we are. I am proud that over the last 10 years we have gone from strength-to-strength, growing both our team, the services and expertise provided to both our clients and referrers. We have achieved countless business rescues and helped directors and debtors through the most difficult times of their lives. By choice we have remained a boutique firm, but still a giant in our technical knowledge and strategy capabilities and long may our clients and referrers benefit. Debi Harvey Director

Highlights The company was established in 2016 and are a nationally recognised ecommerce brand, whose target customer is the over 50’s Woman. o Over £5m in lifetime sales, current average customer spend per transaction £120+ o Wider brand community and social media presence with circa 12k followers on Instagram and weekly “Insta Lives” o Organic international interest delivering C. 10% of web traffic o All garments are 100% made in Italy with 30% of the collection using sustainable fabrics/yarns o Trading from leasehold premises in the Thames Valley o Loyal workforce o Customer database (Circa 50k contacts) o Rated excellent on Trust Pilot, with more than 3,500 reviews, Loyal customer following with low level of returns o Press recognition, including national broadsheet & tabloid publications Further Information Please contact Josie Badman at Harveys Josie@HarveyInsolvency.co.uk to progress your interest.

Highlights o Thames Valley based o Established 2017 o Highly skilled key staff members currently retained o Specialists in the production of bespoke fixtures, including fibre optic and those to IP68 rating o Proven track record with projects involving well known national and international names/brands o Current quotes in the order of £1.1 million o Projects ranging from £2,000 - £186,000 invoice value o Potential for growth particularly in the Middle East marketplace o Tangible assets to include manufacturing and test equipment, internal transport, office furniture and equipment, stock (cost value £158,000) etc o Turnover Y/E 31st March (circa) 2019: £195,000; 2020: £399,000; 2021: £681,000; 2022: £268,000; 2023: £435,000 Further Information Offers invited: Immediately More Information: https://www.lsh.co.uk/assetadvisory/business-sales/architectural-lighting-development-and-manufacturing-company Please contact Josie Badman at Harveys Josie@HarveyInsolvency.co.uk to progress your interest.

Assets include plant and machinery, commercial vehicles, office furniture and equipment, stock – retail and raw material, work in progress, future potential order book and associated intellectual property Highlights o Located in the Thames Valley o Established 2008 o Large and loyal customer base, with strong regional reputation synonymous with quality and luxury o Highly skilled workforce specialising in bespoke product design, manufacture and installation o Trading from two leasehold premises (showroom and manufacturing) o Retailer for major UK kitchen brand. Average kitchen sale value £60,000-£200,000 o Turnover (circa): 2019 - £1.6m, 2020 - £1.6m, 2021 - £1.3m, 2022 - £1.7m Further Information Offers invited: Immediately More Information: https://lnkd.in/eprMmuYF Please contact Josie Badman at Harveys Josie@HarveyInsolvency.co.uk to progress your interest.

Digital content Publisher for Sale! An opportunity exists to purchase the tangible and intangible assets of a well established business offering a digital content publishing, marketing and information service to the independent school sector. Working to integrate luxury brands with schools and their parent community for mutual benefit. Assets available include - Domain name and web content - Telephone number - Database - Notional amount of office furniture & Equipment Highlights o Website/Online School Parent Portal o Established in 2012 o Bolt on opportunity for other website services o Prospect of rolling out internationally o Extensive database of 23,500 o Benefit from £1m of investment in development o Turnover 12 mths to 30.11.22 - £91k 12 mths to 30.11.21 - £159k 12 mths to 30.11.20 - £125k o No TUPER issues o Leasehold offices Further Information Proof of ability to fund purchase and initial trading costs required for enquiry to proceed along with the enquirer signing a NDA before any further information is provided. To protect the Company’s goodwill and trade, it is proposed that any sale will need to be completed on or around 14 December 2022, and as such, this opportunity is only likely to be available for a short period of time. Please contact Josie Badman at Harveys Josie@HarveyInsolvency.co.uk to progress your interest.

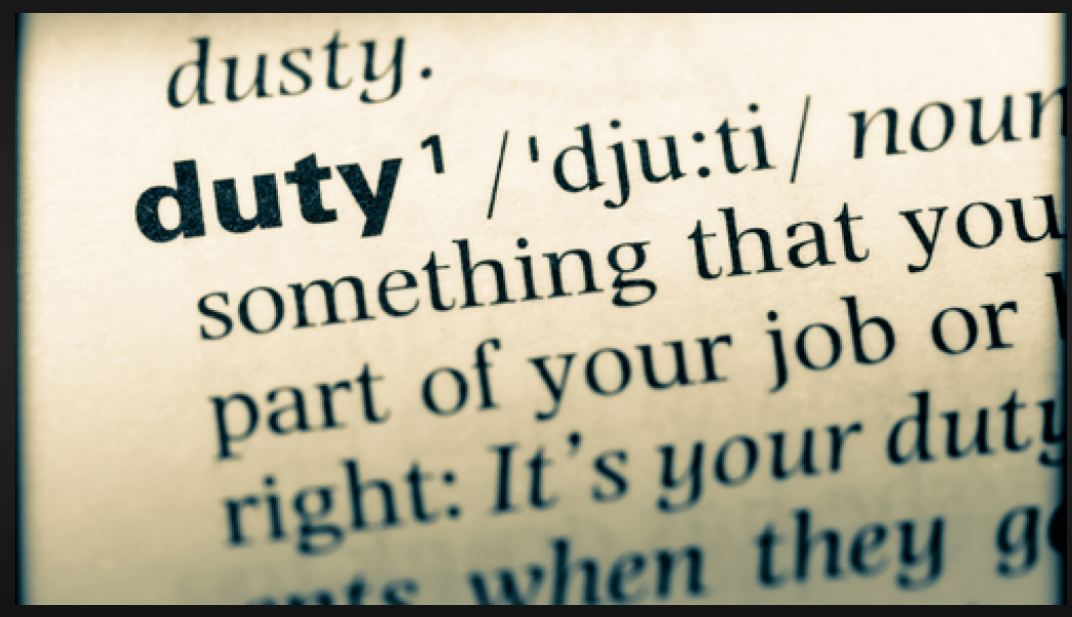

These are undoubtedly unusual times, and no doubt, most businesses have been or will be affected by the effects of the lockdown caused by Covid 19. In the past three weeks, the government has announced a plethora of measures designed to protect the economy, companies and workers. As a part of those measures, the government has recently announced several protective measures to provide some protection to companies and their directors that have been affected by Covid 19. A significant measure was that of the temporary suspension of wrongful trading provisions for a period of three months starting on 01 March 2020. Although the detail has yet to be revealed, it is certainly some cautiously welcome news to directors at these difficult times. As you may know, Directors can be held liable for wrongful trading by a court pursuant to section 214 and 246ZB of the Insolvency act 1986. This is triggered before the commencement of insolvency of a company (liquidation or administration) a director knew or should have known that there was no reasonable prospect that the company would avoid going to into insolvent liquidation or entering insolvent administration and did not take every step with a view to mitigating and or minimising the potential loss to the company’s creditors. Although the suspension of the wrongful trading rules is generally welcome, directors should still remain cautious. There remain alternative ways that the wrongful trading rules can be triggered, these are: Section 172 (3) of the Companies Act 2006; and Common law duties. It must be remembered that these go hand in hand, and the standard law duty is preserved by section 172(3). This route to triggering a claim has not been suspended, can be triggered more quickly than those entrenched in the insolvency act and care should be taken that you are not in breach. The test under the s172(3) trigger is ‘is likely to become insolvent’ rather than ‘no reasonable prospect that the company would avoid going to into insolvent liquidation or entering insolvent administration’ making it less demanding than the wrongful trading trigger. Further, the duty under s172(3) will be engaged where a director knows or ought to have that the company is or is likely to become insolvent on either the cash flow or balance sheet basis. Whereas under the wrongful trading trigger a company goes into insolvent liquidation if it goes into liquidation at a time when its assets are insufficient for the payments of its debts, other liabilities and the costs of the winding-up; i.e. it is balance sheet insolvent. Once again, the s172(3) trigger is an easier route to trigger a wrongful trading claim. There are several other related areas that have not been suspended by the government that are of equal importance and these will be discussed in our blog over the coming weeks. What can you do? Ensure that you hold regular meetings with directors to discuss the financial position and viability of the company, this of course should be undertaken in line with the governments social distancing recommendations; Keep a close eye on the company’s financial position by regularly reviewing the state of affairs, keeping accurate records and by speaking to your internal and external accountants. Keep records and meeting minutes of decisions made and why those decisions have been made, it would be a good idea to ensure that any evidence relied upon in coming to that decision is also kept. Talk to your creditors, this may well be to simply touch base with them so that they understand the position of the company, can alternative agreement be reached. Most importantly, you should take appropriate legal, financial and insolvency advice. *This blog is intended to provide the reader with an understanding of things to consider and should not be relied upon as specific legal advice

Business description The company has been developing a sensor for monitoring wetness in adult incontinence diapers. The optical sensor was intended to be incorporated inside the diaper, during the diaper manufacturing process. Over a three year period considerable research has been undertaken to develop a bespoke (patent-pending) sensor. Although the sensor on its own is working fine, from our research findings it is not particularly suitable for incorporation inside diapers for diaper wetness monitoring. However, the sensor may have applications in other areas. There are two ongoing patents on wetness sensing. The first sensor is based on the expansion of a hydrogel to monitor diaper wetness while the second one is based on light transmission through an optical fibre. Also for sale is a pre-prototype experimental machine for sensor strip manufacture, based on lamination - approximately one strip per minute. Although the lamination process works, the machine requires additional subsystems to produce a complete sensor strip. Highlights Two ongoing patents (pending grant) concerning sensors for wetness monitoring in incontinence diapers A partially built, pre-prototype experimental machine for one of the above stated sensors (fibre optics based) manufacture Turnover Less than £0.5m Sector Engineering, Medical, Technology Region South East England Interested? Please contact Debi Harvey at debiharvey@harveyinsolvency.co.uk if you wish to make further enquiries. Statement of interest must be made no later than 21 November 2020.