Creditors Portal & Information | Harveys Insolvency & Turnaround

Creditors Portal & Information

Information For Creditors

If your customer has entered into insolvency proceedings, at the very least, your cash flow will have been dented & you are probably facing a bad debt. Larger bad debts can impact your profitability & can take many weeks &/or months to return to normal levels. Where we have been appointed to act as insolvency practitioners (IP) to one of your customers, we work hard to minimise your loss & will keep you informed about the case & your prospect of recovering the sums due.

We recommend that you frequently review your customers as a whole & the sums due. If you have suffered a loss recently, we would recommend that you promptly review your customers to identify those whose level & age of debt or financial position concern you so that you can take positive action. Experience tells us that your early action can vastly improve your position.

If you would like to know more about how we can help you, please contact us.

The Creditors Portal & Information section of our website provides useful information for creditors & employees, along with access to our reports & documents pertaining to insolvency appointments we are undertaking.

Creditors Reports

Download your creditors reports

& documents here

Reports for our insolvent clients are provided to creditors, directors & shareholders electronically to improve communications & reduce the cost.

These & other relevant documents are published for creditors & shareholders via our secure portal. We will have provided all known creditors with written notification, a login & password for the insolvent case which provides access to our portal. The 'Creditors Reports & Documentation' button on the left takes you to our portal login area.

Please contact us should you experience any problems whilst logging in or downloading.

Our Standard Charges & Pricing

We do as much as we can to be open & transparent about our fees & the costs associated with all the work we do. Like most professionals our normal basis of charging is on time costs based on charge out rates which vary depending on the grade & experience of individuals involved. We believe that our charge out rates are very competitive. We provide a more personal, but otherwise similar level of service to the larger national business rescue & insolvency firms, but at less than 50% of the price.

Advisory Work

We don't charge you for the initial advice or will not charge until we agree the terms of an engagement with you. The only exception is non business related cases, such as consumer debt problems, where we will charge a fixed fee for initial meetings.

We always agree a basis for charging before work commences, either as a fixed fee, time spent on your matter or on a percentage of results achieved. If we are charging on a time basis we will give you an estimate of the total fee & agree further fees arising over & above that estimate, if required.

Formal Insolvency Work

In formal insolvency appointments we normally charge for work undertaken on a time incurred basis, subject to the law & guidelines stated by our professional body & legislation. When we apply for fees we furnish creditors, shareholders & directors, as appropriate, with our fee policy & an estimate of the anticipated total fees & a supporting narrative. The Statement of Insolvency Practice (SIP) 9 can be found at:

This states the basis on which IPs should charge & report on fees. The following link provides ‘A creditor’s guide to fees’ for each type of proceedings:

✔ Administration

✔ Liquidation

✔ Trustee in Bankruptcy

✔ Voluntary Arrangements

Insolvency

Practitioner Fees

Guide to your rights as an employee

Harveys' approach to employee rights

Be assured that when Harveys are instructed to act for an insolvent employer, we ensure that all employee claims are treated as follows:

✔ CN Codes are provided as early as is possible to employees.

✔ All known employees with rights are given an opportunity to claim from the RPS.

✔ P45s & all employee tax matters are completed as soon as is possible.

✔ Pension contributions are considered & outstanding monies recovered from the RPS & paid to the scheme where possible.

✔ Where pension schemes require the appointment of an independent trustee, they are addressed quickly.

✔ When documents are prepared at the outset of a case, where information is provided by the employer we will calculate the employees' contractual or ERA anticipated claim for us to estimate what the employees’ positions are likely to be.

✔ In the course of preparing for a preferential or unsecured distribution to creditors, we will review the known employees' position, reconcile our calculation with the RPS & ensure the employees' full rights are carefully considered and addressed.

RPS Guide

https://www.gov.uk/your-rights-if-your-employer-is-insolvent

RPS Forms

https://www.gov.uk/claim-redundancy

RPS Contact

Tel:

0300 123 1100

Please refer to the guide on the right to your statutory & contractual rights & their treatment in insolvency.

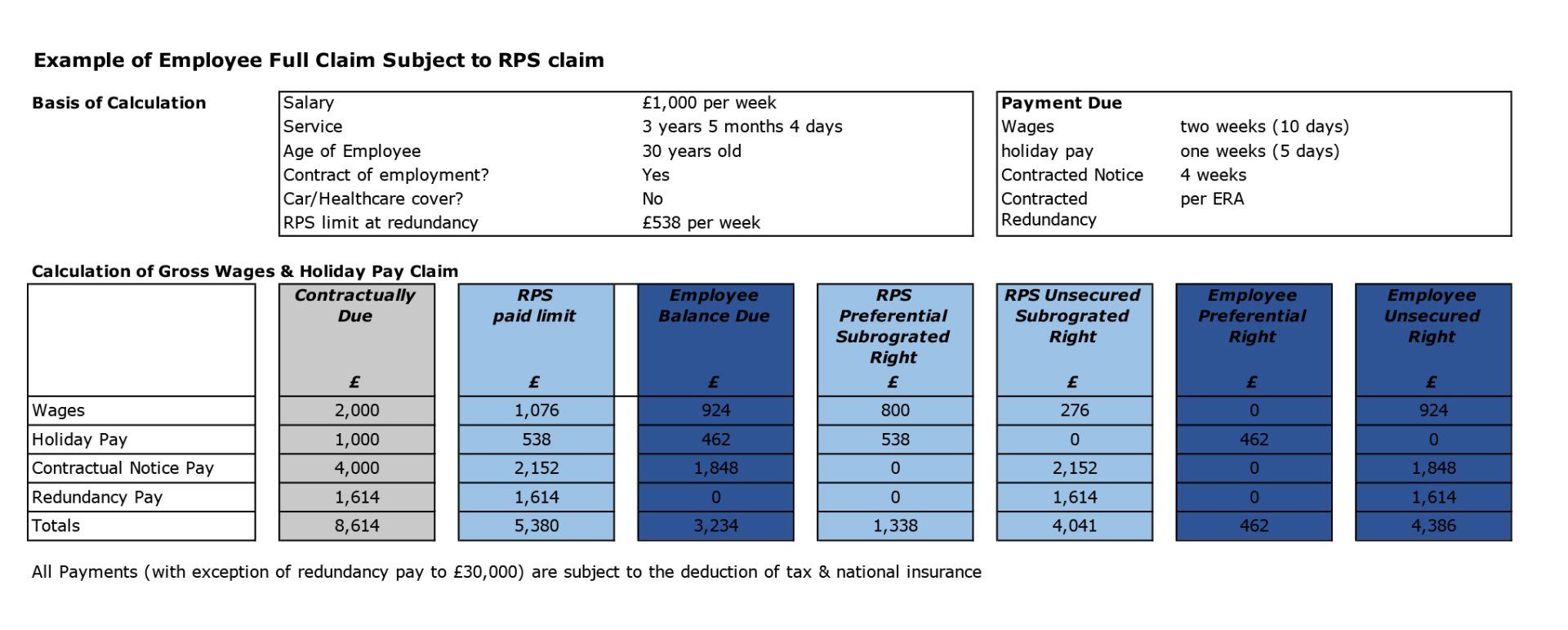

Basis Of Calculation

Employees of an Insolvent Company or Trader?

If your employer has become or is insolvent & you are owed money by them, it is more than likely you will be entitled to make a claim to the Redundancy Payments Service (RPS) for some or all of the money you are due. Employees' claims initially fall into two categories:

- The amount you can claim from the RPS.

- What is payment under your contract of employment & in the absence of a contract what your entitlement is under the Employment Rights Act 1996 (ERA) .

1. Redundancy Payments Service Payments

Employees can only submit a claim to the RPS once they have been provided with a CN code. This will be provided by the IP engaged by your employer after their appointment.

The RPS guide on your rights if your employer is insolvent can be found here:

https://www.gov.uk/your-rights-if-your-employer-is-insolvent

If you have a CN code for your employer, you will find the application & the guidance here:

https://www.gov.uk/claim-redundancy

The scheme operated by the RPS will pay sums due to a maximum statutory rate of £700 per week (2023/4 rate, increases annually on 6 April) for the following: -

✔ Arrears of wages due to a maximum of eight weeks.

✔ Accrued holiday paid to a maximum of six weeks.

✔ Pay in Lieu of Notice (PILON) , where an employee meets minimum service requirements & this is calculated based on your notice rights under the ERA. One week for each complete year served, to a maximum of 12 weeks.

✔ Redundancy pay at statutory scale as defined by the ERA.

In return for paying employees, the RPS will, for the greater part, take your place as a creditor in the proceedings.

The RPS & IP should make sure you receive your entitlements as quickly as possible. However, no claims can be processed until after the actual commencement of the insolvency proceedings when the IP is entitled to submit information on behalf of the employer.

These payments do not consider the contractual claim of the employee or any shortfall if your wages are above the maximum statutory sum; if you have no contract or your contract is silent on a particular right, employees are protected by rights stated under the ERA.

2. Employment Contracts & Shortfalls

We understand that employee claims can be complex & it is not easy for all employees to interpret & or navigate a contract of employment or the ERA. Because of this, Harveys calculate all employee claims throughout the proceedings & where we need employees' comments, we contact you again at the appropriate juncture.

Employees have two creditor statuses, which are defined by the provisions of the Insolvency Act 1986:

✔ Preferential Creditor for: Arrears of wages up to a total of £800; & All accrued holiday pay.

✔ Unsecured Creditor for: Arrears of wages above £800.

Notice pay. Redundancy Pay. Expenses.

If you have a contract of employment, your claim in the proceedings will be calculated based upon your contract. If no contract exists or your contract is silent in specific areas, the ERA or case law prevails. By applying for & receiving payments from the RPS, referred to earlier, you agree that they have subrogated rights to your preferential or unsecured claim against your employer.

A subrogated right means you have given them priority to be paid first, in full or part, before you receive any payments directly from the employer. The subrogated sum is still broken down into the preferential & unsecured categories & then wages, holiday pay etc. The RPS use a statutory calculation to arrive at a legal sum they are entitled to recover under subrogated rights, which is generally >97% of what they paid you. Any sum due to you which the RPS has not paid is considered separately by the IP. Below we have set out an example of a claim demonstrating the apportionment of:

✔ Actual Claim due

✔ Preferential or unsecured status

✔ Subrogated or balance to employee